What’s New and What You Should Know

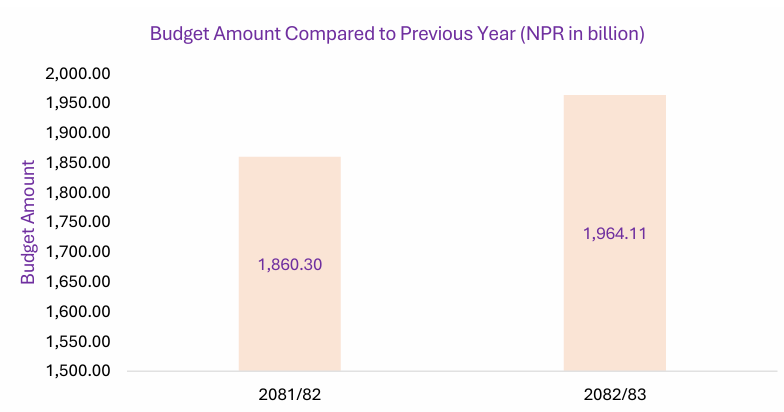

On Thursday, 29 May 2025, Honorable Finance Minister Bishnu Prasad Paudel presented the national budget for the fiscal year 2082/83 (2025/26). The government announced a total budget allocation of Rs. 1.964 trillion, aiming to support economic recovery and long-term development.

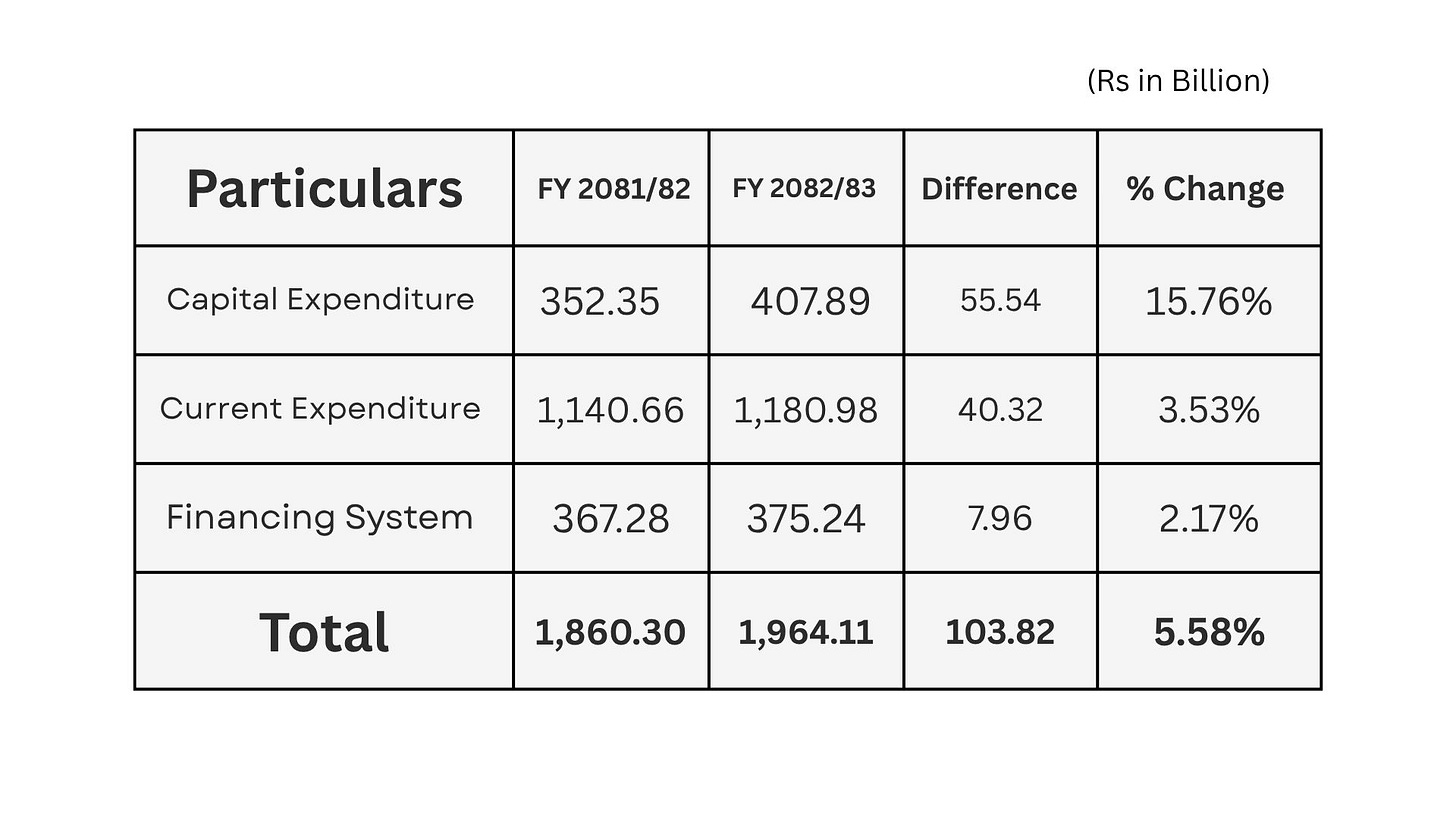

Here’s how the government plans to spend the allocated Rs. 1.964 trillion:

Recurrent Expenditure: Rs. 1.180 trillion

Capital Expenditure: Rs. 407 billion

Financial Management (including public debt servicing): Rs. 375.24 billion

This year’s budget emphasizes infrastructure, education, healthcare, energy, digital innovation, and social protection.

🔎 Quick Look

- 🏛 Total Budget: Rs. 1.964 trillion

- 🧾 Highest Allocated Sector: Education (10.7%)

- 🚀 Focus: Jobs, Digital Tech, Clean Energy📊 Budget Highlights & Breakdown

Allocations of Budget

The allocation of budget for Capital Expenditure has increased by 15.76%, Current Expenditure by 3.53% and the allocation for Financing System has increased by 2.17% as compared to previous year’s budget.

The total budget for the year has increased by 5.58% from Rs1860.30 billion to Rs 1964.11 billion.

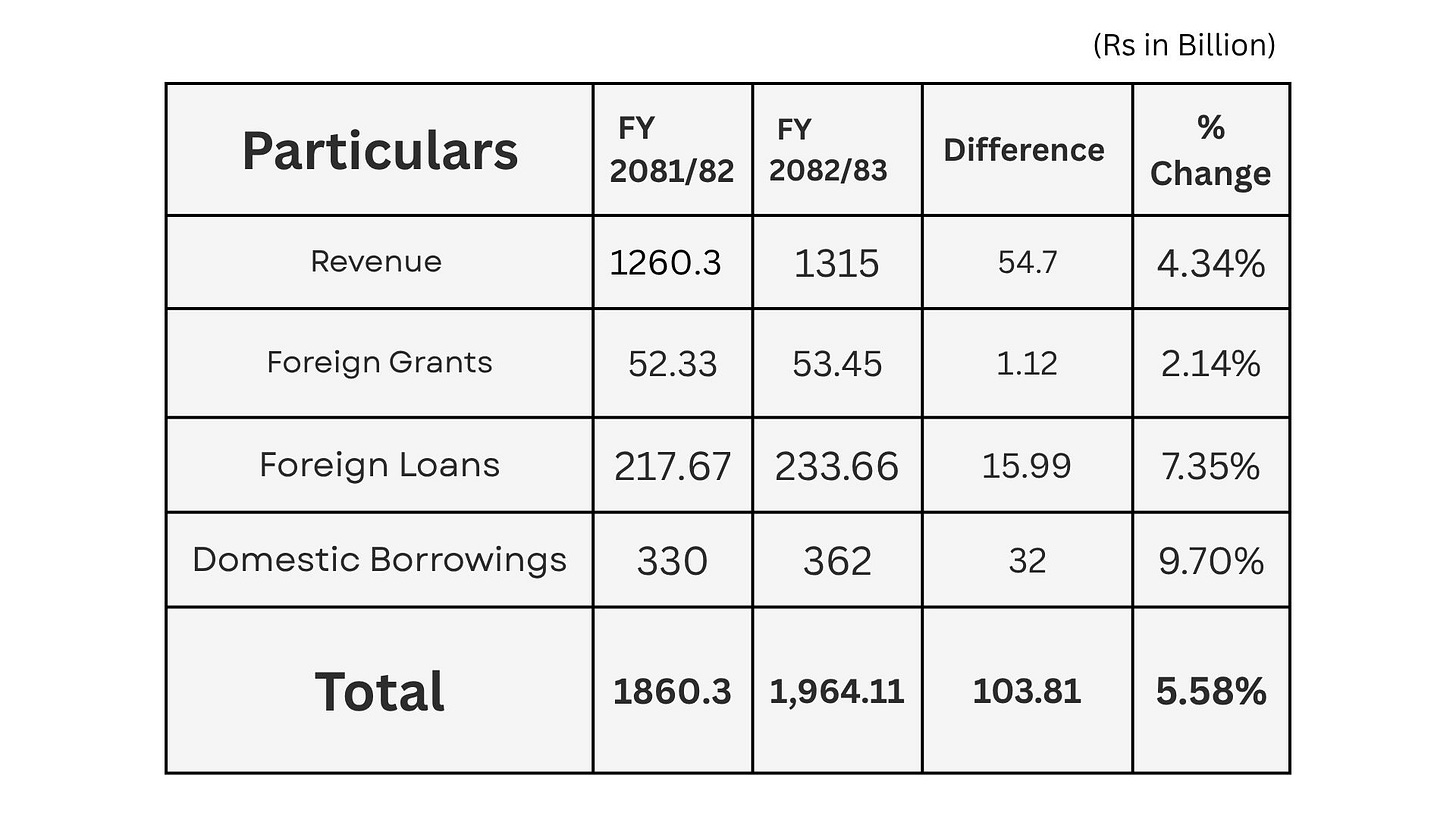

📈 Revenue Sources

The source of budget through Revenue has increased by 4.34%.

The source of budget through foreign grants, foreign loan and domestic borrowings have increased by 2.14%, 7.35%and 9.70% respectively.

There has been a total increment of 5.58% as compared to previous year’s budget.

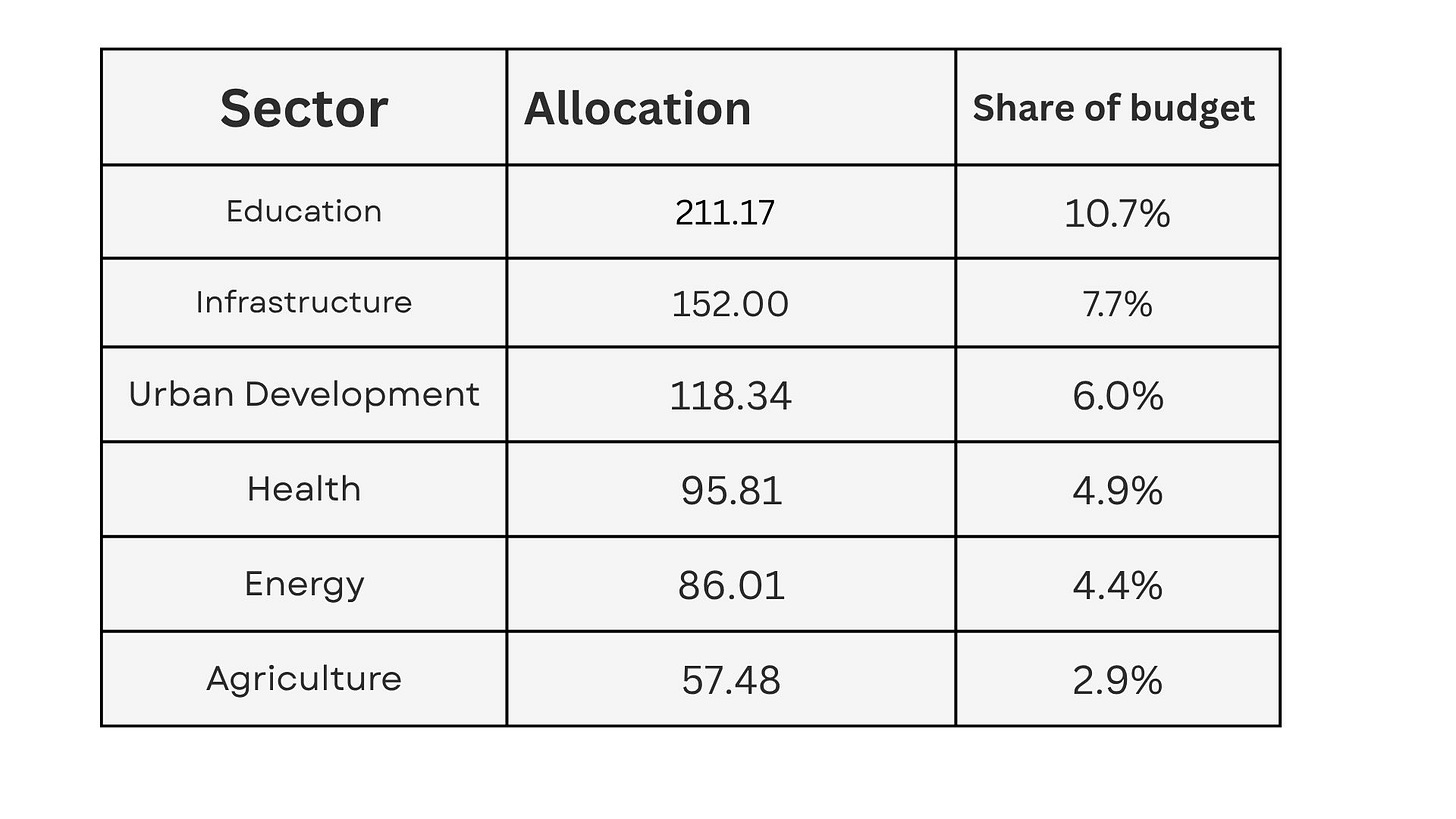

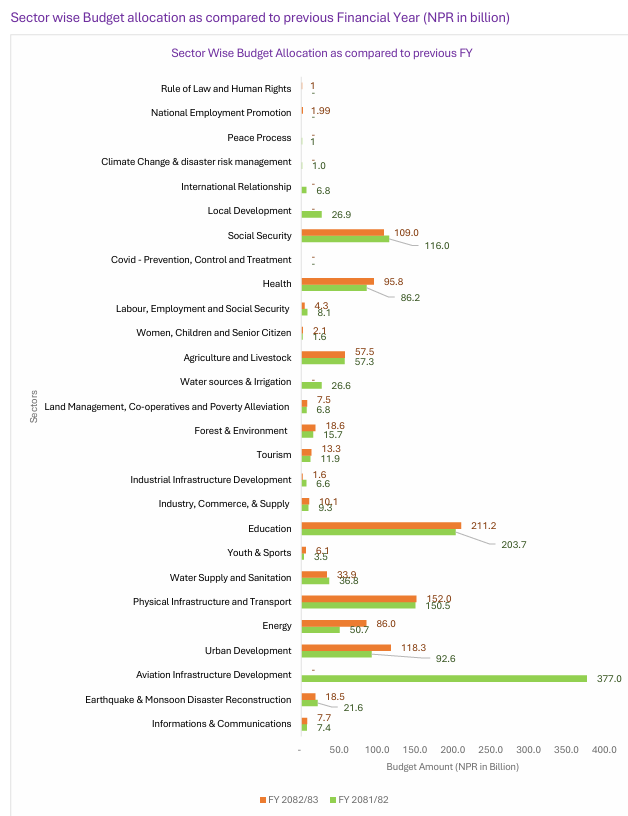

🧮 Sector-Wise Budget Allocation

Six key areas have been highlighted for major investment:

These Six sectors together make up nearly 37% of the total budget. Meanwhile, sectors such as labor, employment, and social security have seen minimal reductions.

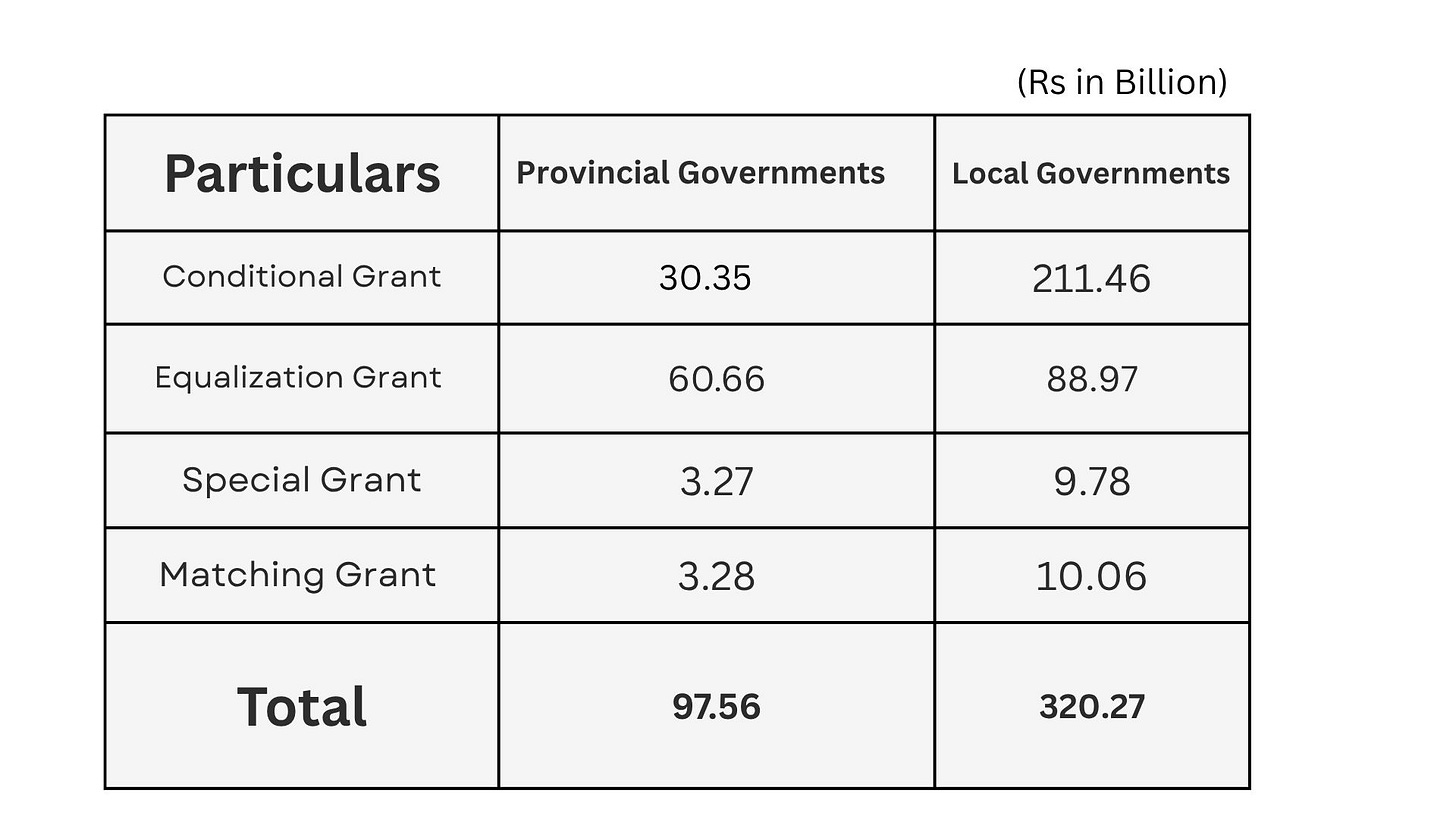

🔄 Fiscal Transfers

Fiscal transfers help to implement federal policies at local and provincial levels.

These include:

- Equalization Grants: Unconditional transfers to ensure service delivery

- Conditional Grants: Funds tied to specific programs

🎯 Objectives of the Budget

The key objectives of the FY 2082/83 national budget are as follows:

- To achieve high, sustainable, and inclusive economic growth with the aim of reducing poverty.

- To foster entrepreneurship and expand public-private investment in order to generate employment opportunities.

- To enhance economic efficiency by promoting the use of modern technology.

- To advance social justice through strengthened social protection and inclusive development.

- To ensure the delivery of quality public services and promote effective governance.

📌 Priority Areas

The budget outlines the following as priority areas for the fiscal year:

- Promotion of entrepreneurship, employment generation, and increased productivity.

- Investment in quality, results-oriented physical infrastructure.

- Improvement in the quality of services within the social sector.

- Balanced regional development and strengthened social security systems.

- Delivery of citizen-focused services, along with reforms in governance and anti-corruption measures.

📈 Targeted Economic Growth Rate and Inflation Rate

- Expected Economic Growth Rate for FY 2082/83 is 6%

- Expected Inflation rate for FY 2082/83 is 5.5%

💰Tax Highlights-Key Changes You Should Know

The FY 2082/83 budget has introduced several tax changes-here are the key ones to know :

🖥️ Digital Service Tax

A 2% tax will be applied to all digital services provided by foreign(non-resident) companies to Nepali users.

Exemptions for Providers earning under Rs. 30 lakh/year and B2B digital exports.

💍 Luxury Tax on Gold

A 2% luxury tax now applies to all gold ornaments, regardless of value. Previously, this tax was limited to items valued over Rs. 10 lakh.

🚀 Startup Income Tax Exemption

Startups with annual income below Rs. 10 crore are now exempt from income tax for five years from the start of their business operations.

♻️ Full Tax Exemption for Green & Clean Tech

Companies producing green hydrogen and Manufacturers of electric vehicle (EV) charging machines both are fully exempt from income tax.

⚠️ Health Risk Tax

A new health risk tax has been introduced on the production and import of harmful products such as tobacco and alcohol while the tax rate varies by product and is designed to discourage consumption while supporting public health initiatives.

🆕 Key New Programs Introduced and Policy Changes in FY 2082/83

🎓 Youth, Employment & Entrepreneurship

- “Learn and Earn” program launched: students can work up to 20 hours per week with minimum wage.

- Internships to be introduced in public institutions.

- A national Employment Portal will connect skilled youth with job opportunities.

- A Startup Incubation Center will be established in collaboration with the universities and the private sector.

- Women-led businesses will be exempt from registration and renewal fees.

💻 Technology & Innovation

- An Artificial Intelligence and Machine Learning Research Center will be set up in partnership with the private sector to support research and development.

- Telemedicine and AI-powered healthcare services will be expanded, including the use of robotics in advanced medical procedures.

🌾 Agriculture & Rural Support

- The new KISHAN App will provide farmers with real-time weather updates, crop prices, and input availability through SMS notifications.

🏢 Industry, Trade & Investment

- The “Make in Nepal, Made in Nepal” campaign will be revived in coordination with the private sector to promote domestic production.

- Non-resident Nepalis (NRNs) will now be allowed to invest in Nepal’s secondary market.

👥 Social Protection & Public Services

- The senior citizen allowance will now be available to individuals aged 70 and above (reduced from previous criteria).

- Forest and government-owned land can now be leased to develop tourism infrastructure such as hill stations, lodges, and resorts.

- Drinking water projects aim to cover 98% of the population by the end of this fiscal year.

👀 3 Things to Watch This Year:

- Will the “Learn and Earn” program effectively reach students nationwide?

- Can the government fully implement capital projects this year?

- Are tech and AI investments symbolic or transformative?

Which part of the budget excites you the most?

Comment, reply, or share this article to help others stay informed.

🖋️ Saksham Ghimire

✉️ Subscribe to get next week’s civic brief straight to your inbox.