Many young Nepalis have long wondered when PayPal will finally be available in Nepal. People who try to earn online through freelancing, content creation, or selling digital products often face the same problem: getting paid from clients abroad is difficult and risky. Most either rely on relatives abroad, use informal channels, or give up entirely. Nepal Rastra Bank (NRB) is now working to change this by planning to bring PayPal to Nepal through partnerships with local institutions like Fonepay & Standard Chartered Bank. This system will allow Nepalis to receive international payments safely and legally, opening new opportunities for freelancers, small businesses, and digital creators.

Nepal has already taken a major step forward with India’s Unified Payments Interface (UPI), which allows Indian users to pay Nepali merchants instantly using QR codes, converting rupees automatically. This system benefits merchants and tourists alike, making payments seamless and fast. Fonepay manages the technical network, connecting over 1.7 million merchants, while Standard Chartered Bank ensures regulatory compliance and international money handling. The success of UPI shows that Nepal can adopt modern payment systems, and it lays the foundation for PayPal to operate in the country.

Digital payments have significant economic implications. By enabling youth to work for international clients from home, platforms like PayPal create new employment opportunities and could reduce the need for remittance-based income. Nepal currently relies heavily on remittances, which make up over 23 percent of its GDP according to the World Bank. Freelancers, online tutors, programmers, and content creators can earn money legally without leaving the country, while small businesses can access global markets and increase their sales. This expansion directly improves productive capacity, meaning Nepal can produce and sell more goods and services efficiently, supporting economic growth from within rather than depending on migration.

India faced similar challenges a decade ago when freelancers struggled to receive international payments. But after integrating PayPal and strengthening digital systems like UPI, India’s freelance economy grew rapidly. According to Payoneer’s 2022 Global Freelancer Report, India is now one of the world’s top three freelance-earning countries, generating over 500 million dollars annually. Nepal has already followed India in adopting UPI, and if it successfully enables PayPal next, it could replicate the similar digital employment boom.

Digital payments also strengthen formal remittance flows. Nepalis working abroad can send money home faster, cheaper, and more securely. More money reaches families legally, who can spend it on their education, health, food and small businesses. This supports the formal economy and reduces reliance on risky third-party channels. With over 19 million registered mobile wallet users in Nepal as of 2023 (NRB report), the population is already familiar with digital money management, making the shift to PayPal adoption much easier.

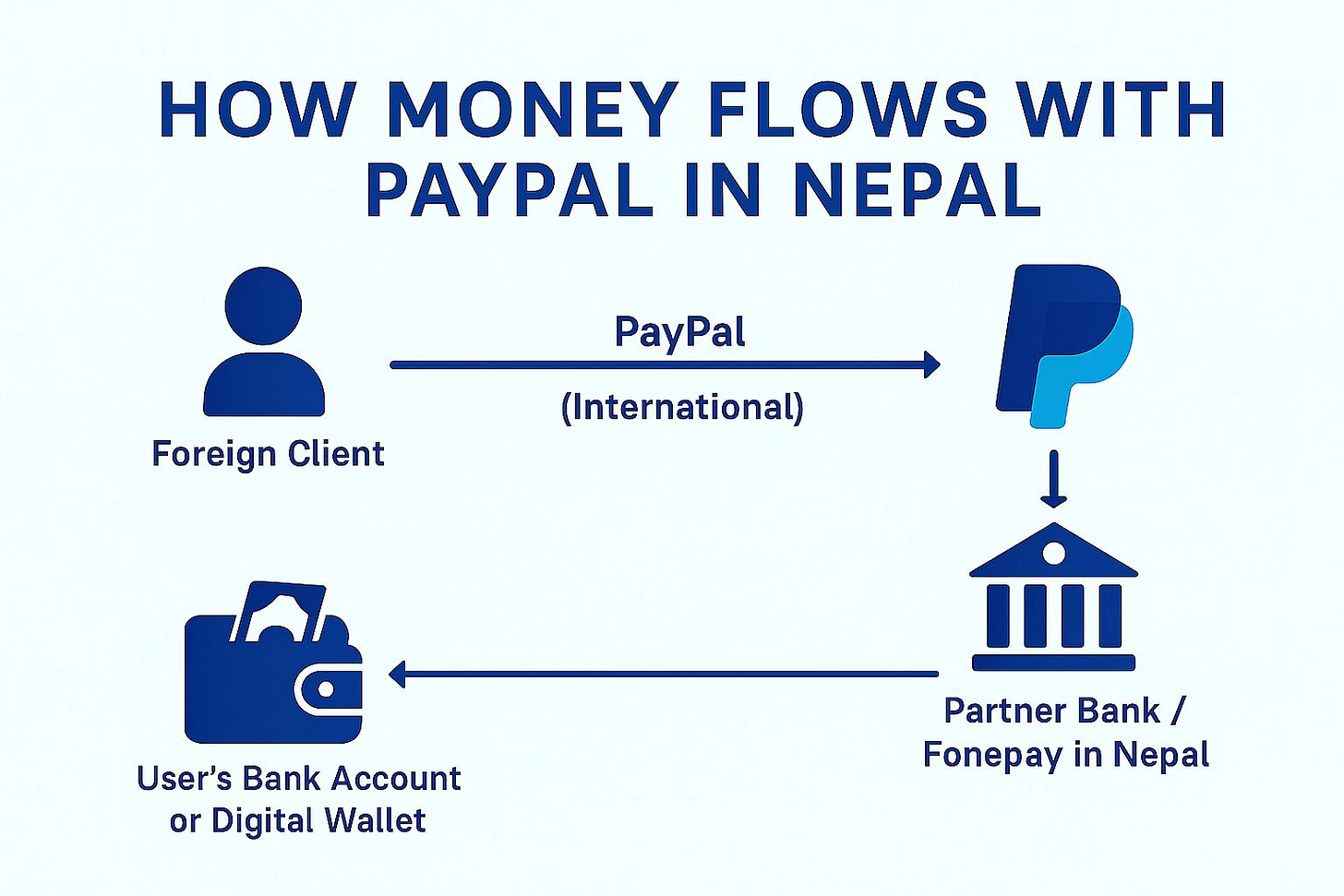

Fonepay and Standard Chartered Bank will be crucial in making PayPal work in Nepal. Fonepay will provide the technological network to process payments safely, while Standard Chartered Bank will handle the banking infrastructure, ensure compliance with NRB rules, and manage international settlements. This partnership will help prevent fraud while making the system secure and reliable for Nepali users.

Technology plays a critical role in economic development. Systems like UPI and PayPal reduce transaction costs, speed up payments, and connect businesses and freelancers to global markets. By encouraging digital entrepreneurship and skills development, digital payments increase productivity, create jobs, and allow Nepal to participate more actively in the global economy.

While digital payments bring many benefits, challenges remain. Fraud, cyberattacks, and unclear regulations on freelance versus business income could pose risks. High fees or poor exchange rates may also slow adoption, and traditional remittance companies could resist change. Careful monitoring, clear rules, and phased rollout are essential. Tools like Know Your Customer (KYC), already used in Nepali e-wallet apps, will help verify users, prevent fraud, and build trust; laying the foundation for PayPal’s safe entry into Nepal.

This flow shows how digital payments not only help individuals but also increase productive capacity, bring money into the country legally, and strengthen the economy. Money received through PayPal can be spent locally, invested, or used to grow businesses, creating a positive cycle of growth.

The rollout of PayPal in Nepal is expected within the next one to two years. Initially, there may be limits on withdrawals and transactions to prevent misuse. NRB and its partners will need to educate users about safe practices and provide incentives for youth and small businesses to use the system legally.

If implemented successfully, PayPal will allow Nepali youth to earn safely online, work from home, sell services and products globally, and develop digital skills. Beyond individual benefits, it strengthens the formal economy, increases productive capacity, and creates more job opportunities. Nepal can shift from exporting labor to exporting skills, keeping talent in the country while participating in the global digital economy.

🖋️ Aastha Rauniyar